S&P 500 Overview

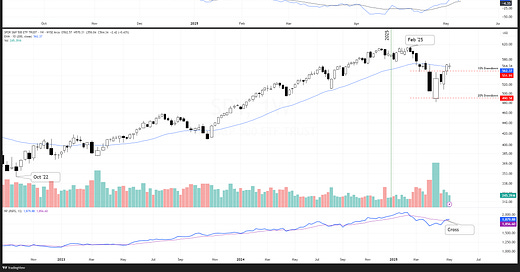

This was a quiet week for the S&P 500 (SPY). Price remains in the fuzzy area around the 200-day EMA and the July 2024 high. It appears that SPY is finding resistance at the 200-day EMA.

Over the past couple of weeks, we have seen the poorly performing factors begin to recover, and the momentum factor, specifically, is seeing a strong recovery.

Sector Overview

Sector performance was relatively flat this week, except for Healthcare (XLV).

Spots of weakness are beginning to show in the short term, and the long-term breadth remains weak in most sectors. So far, the strong short-term breadth has not been able to translate itself into strong long-term breadth. Lining up with the resistance we see at the 200-day EMA at the index level.

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.