S&P 500 Overview

The SPY closed higher this week but remains over 10% below its peak. In comparison with other assets, the SPY remains far off its high.

After the rally on April 9th, SPY traded within the range of that day's candle until Friday. On that day, SPY closed above the body of the candle, which can be considered a bullish break and a sign of strength.

The equal-weighted SP500 (RSP) also closed above the body of the April 9th candle, implying strength.

Sector Overview

Breadth across the sectors remains weak on the more extended time frames, but is improving on the shorter ones. The exception is Utilities (XLU), which shows strength across all time frames except the shortest.

Strong breadth performance was accompanied by strong price performance across the sectors. Technology (XLK) was the top-performing sector. Consumer Staples (XLP) was the only sector negative for the week. Even with this strong performance, only three sectors—Healthcare (XLV), XLP, and XLU—are positive for the year.

Although XLP had a challenging week, it still shows strength on the weekly RRG, similar to XLU. However, XLV has started to trend downwards.

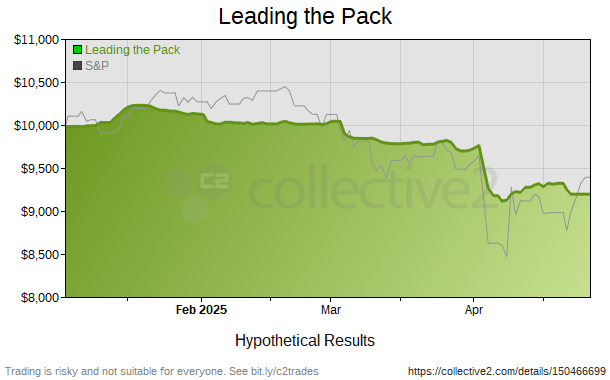

Performance Update

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.