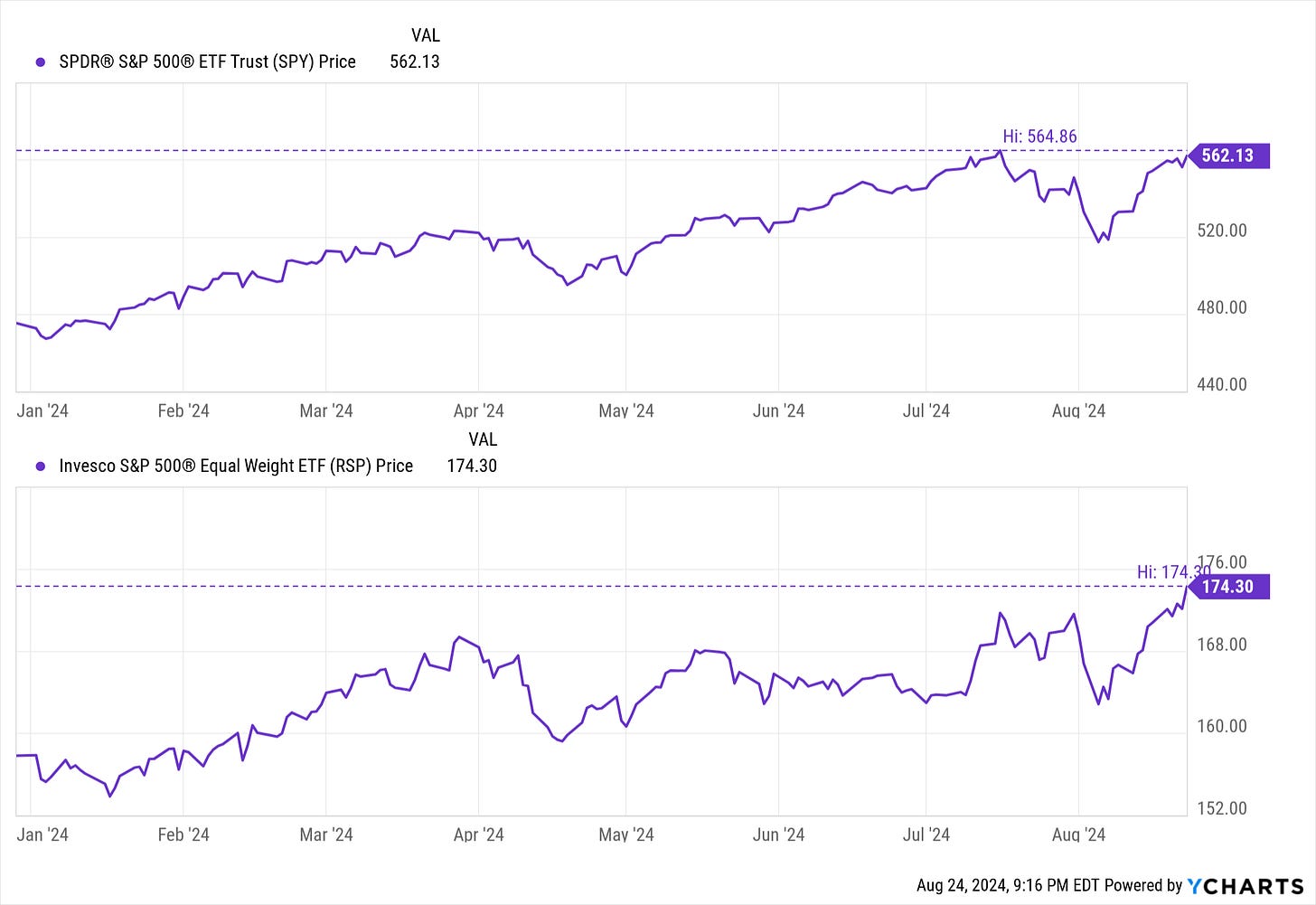

This week ended with the uncommon event of the RSP (the equal-weighted SP500) posting a new all-time high, while the SPY failed to achieve new all-time highs. This shows that there is strength in the market outside the Magnificent Seven, which has carried the index for most of the year.

Looking at the performance attribution for RSP over the past week, we see names such as ALB, TGT, BLDR, and KEYS as the top contributors to performance. Noticeably, Technology names are absent.

This robust performance from various sectors is also reflected in the market breadth. Energy showed signs of strengthening, while the rest of the sectors maintained their strength. Breadth also picked up in small and mid-cap stocks.

Real Estate led in performance, followed by Consumer Discretionary. Overall, the market seemed encouraged by the prospect of rate cuts later this year. Energy lost a little this week.

Going into next week, I am watching to see if SPY can join RSP in posting a new all-time high. This week also marked three up weeks in a row, so I would not be surprised if SPY takes a breather and does not do much next week.

Thank you all for reading, and I hope you had a great week!