S&P 500 Overview

The S&P 500 (SPY) set new all-time highs to end the week on Friday.

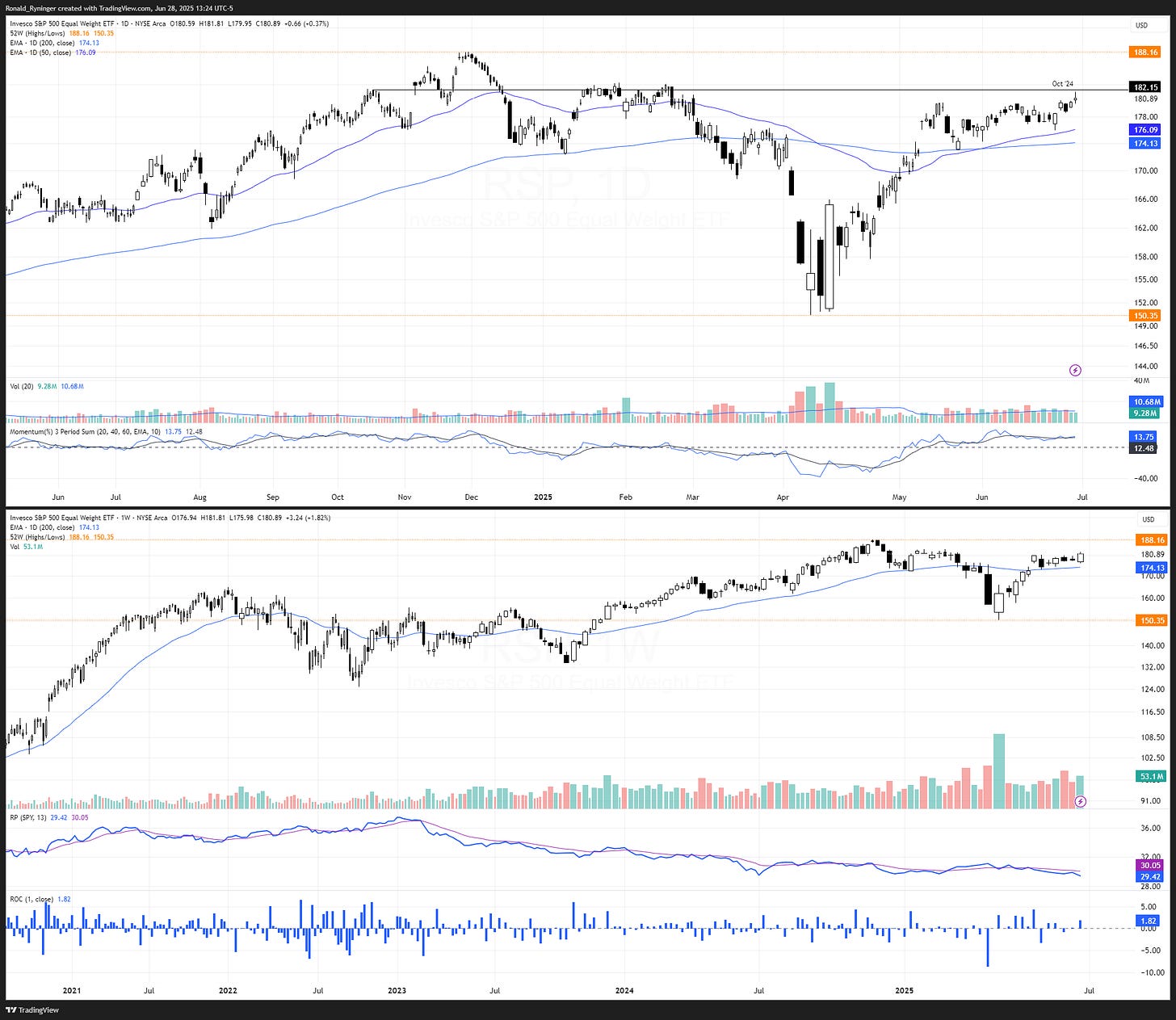

This milestone was not mirrored in the equal-weighted S&P 500 (RSP), which continues to trade below its October 2024 high.

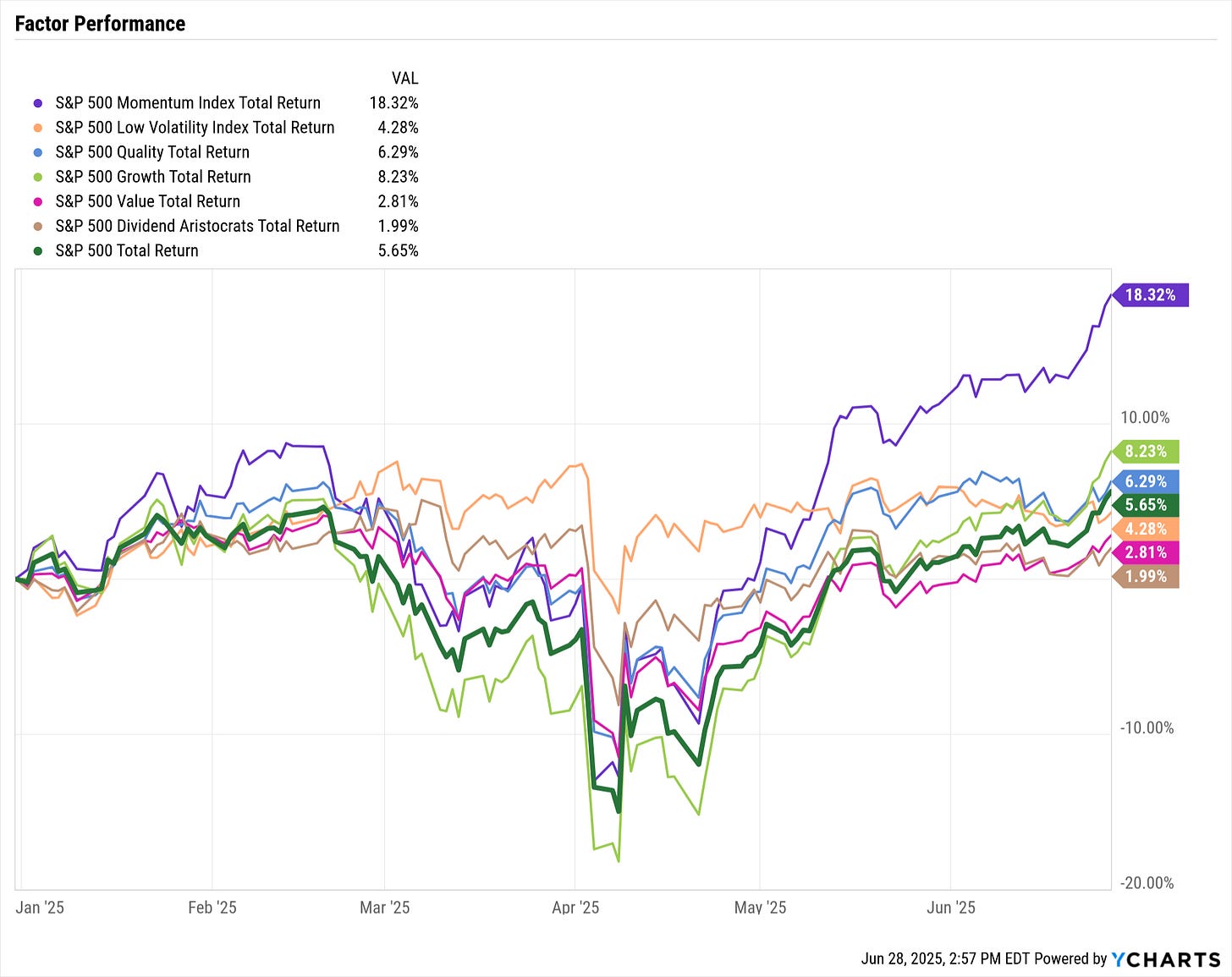

Factors across the board appeared to benefit from this week, with Momentum closing in on a 20% return.

Sector Overview

Communications (XLC) and Technology (XLK) were the top-performing sectors this week. Industrials (XLI) continues to lead in year-to-date performance, but XLC is close to surpassing it. Energy (XLE) was the laggard this week and is negative for the year. So far this year, Healthcare (XLV) and Consumer Discretionary (XLY) are the worst-performing sectors.

Breadth is improved across almost all sectors, with notable weakness in Consumer Staples (XLP) and Utilities (XLU). The Midcap and Smallcap indexes also show strength.

Thoughts and Comments

Prominent tech companies played a significant role in this week's rally of the SPY, leading it to break records during an already exciting time. However, due to the RSP's lackluster performance, I will be monitoring it closely this week. Watching to see if it manages to trade above its October 2024 high.

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.