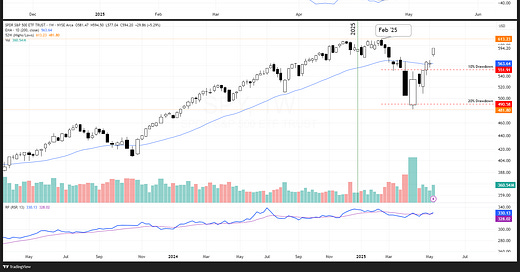

S&P 500 Overview

The pause in the S&P 500 (SPY) observed last week resolved this week with a gap higher, pushing SPY into positive territory for the year.

All factors across the S&P 500 are also in positive territory for the year, with momentum moving to the top spot. The momentum factor has now surpassed its February high.

Sector Overview

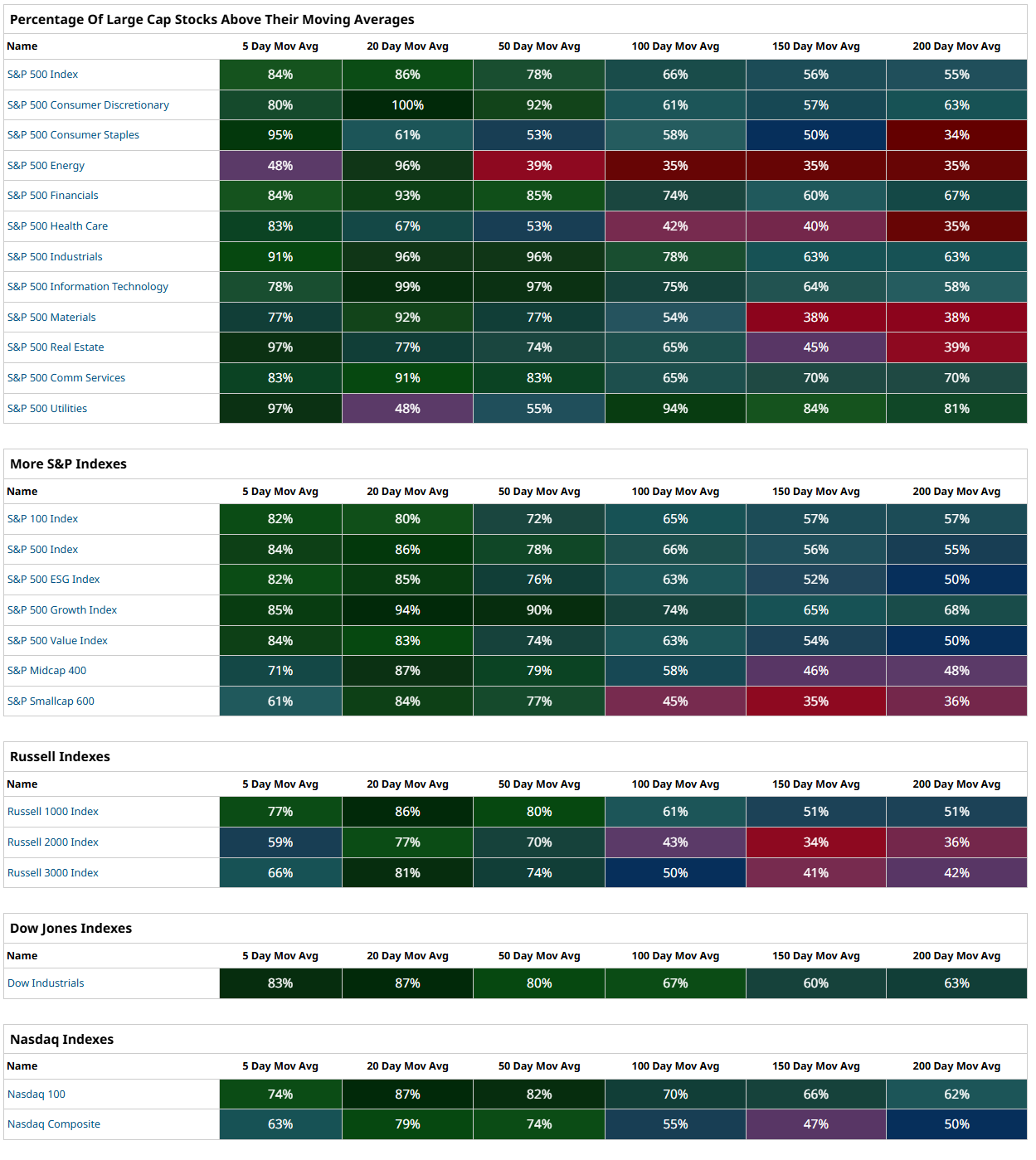

No sector saw negative performance this week, with Technology (XLK) leading the way with an almost 8% return. Industrials (XLI) is leading the sectors in year-to-date return. Healthcare (XLV) was the worst-performing sector this week and has the worst year-to-date returns.

Breadth improvement is now being seen in the more extended time frames. Some sectors, such as Energy (XLE), still display weaknesses. XLI is showing robust breadth across all time frames, appearing strong as it leads in the S&P 500 in returns this year.

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.