S&P 500 Overview

Monday of this week was a big day. The SPY crossed the 20% drawdown mark, which traditionally signifies a bear market. It did not spend long below this level.

On Monday, the SPY also reached the 50% retracement between the October 2022 low and February 2025 high. By the end of the week, it had rebounded and is now closer to but still below the 10% drawdown level.

When looking at different factors within the SP500, Growth still lags the index in year-to-date performance.

Sector Overview

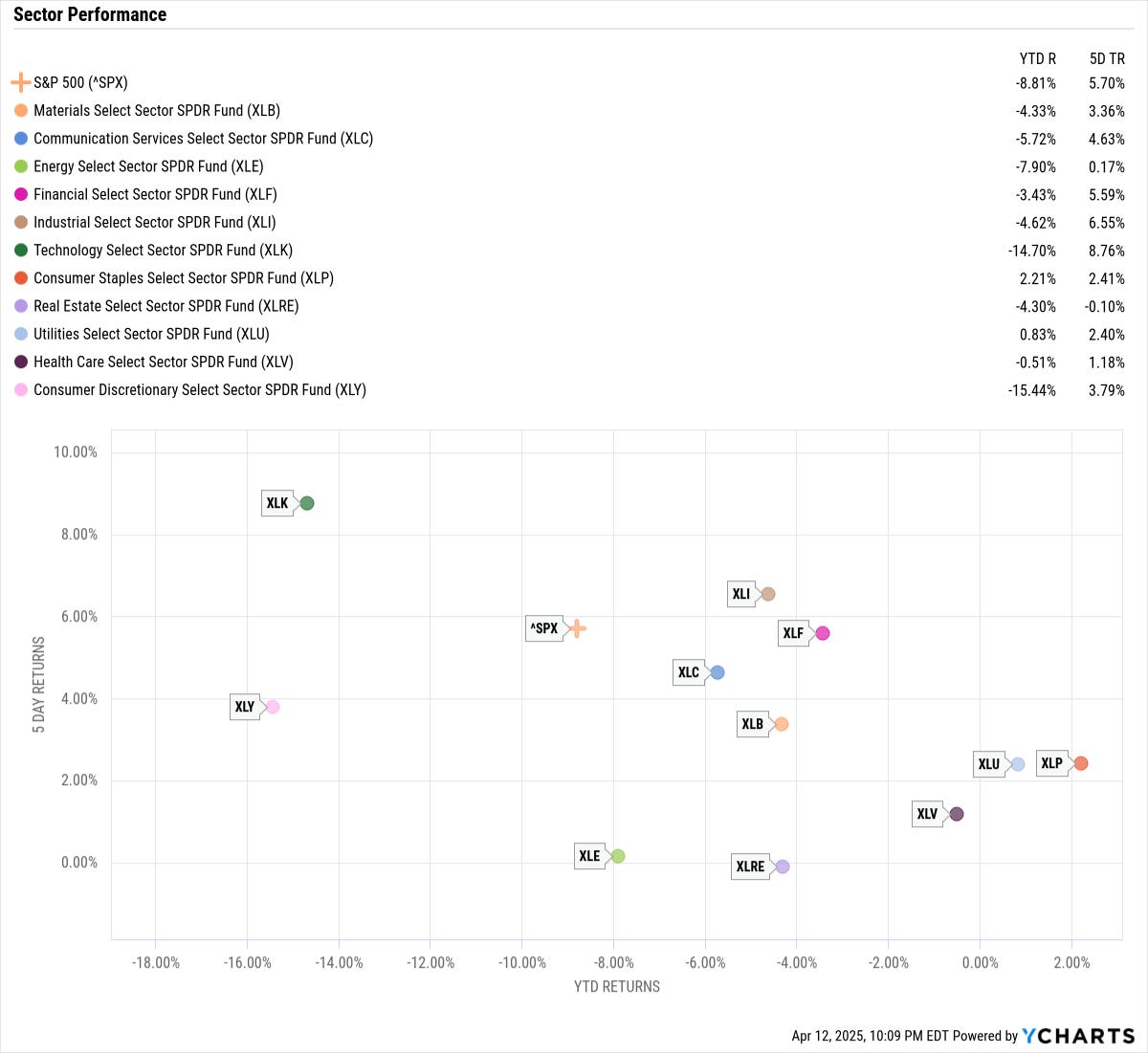

Looking at the weekly RRG, Utilities (XLU) and Consumer Staples (XLP) show strength as they progress through the leading quadrant. Technology (XLK) and Consumer Discretionary (XLY) remain lagging.

Despite XLK being the top-performing sector this week with an 8.76% return, it remains the second-worst year-to-date, with XLY being the worst year-to-date. Real Estate (XLRE) was the only sector that did not show positive performance this week.

This week, short-term breadth showed strength across all sectors, with XLP and XLU displaying signs of strength on longer timeframes.

Performance Update

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.