S&P 500 Overview

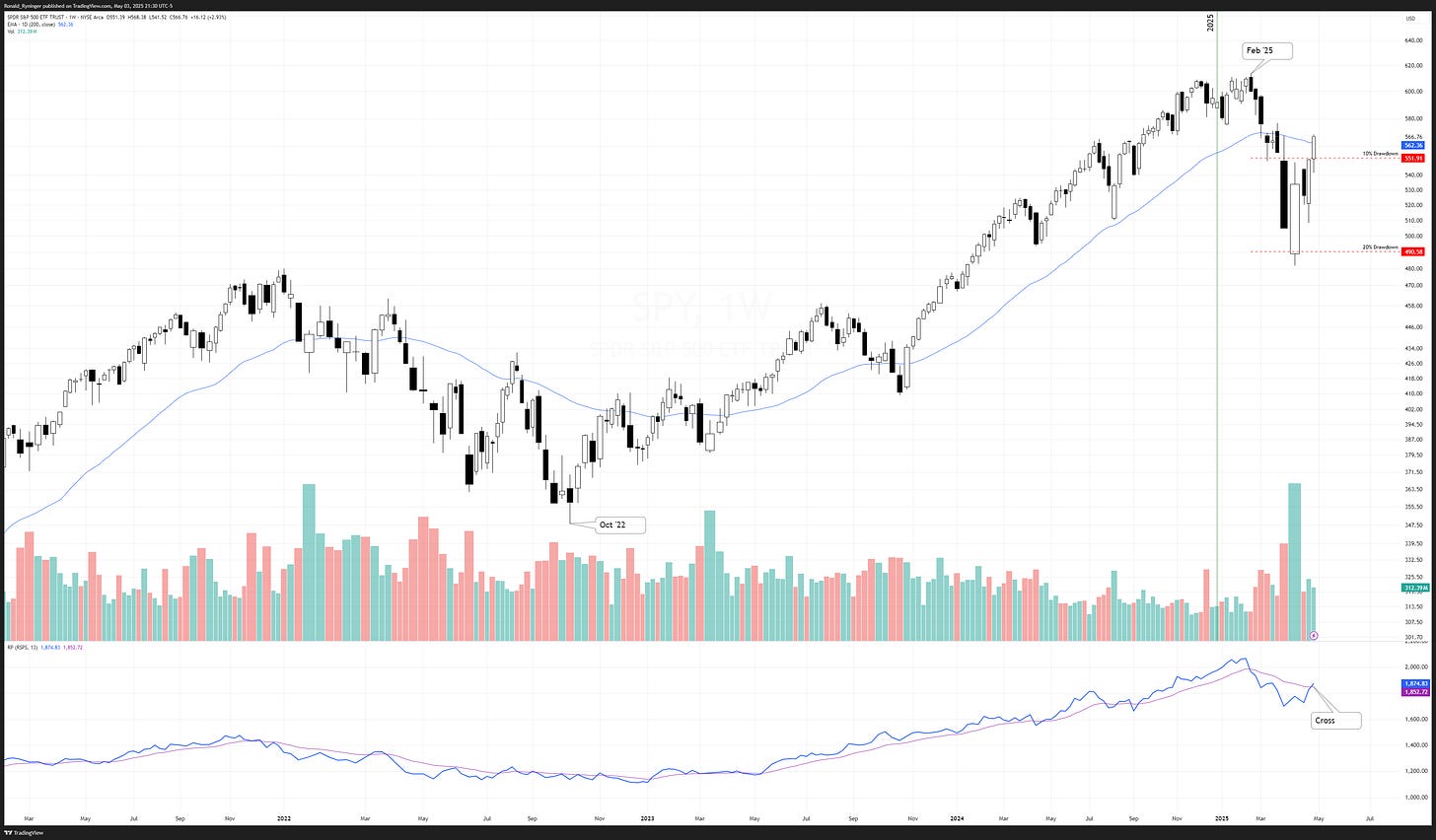

After a hesitant start to the week, the S&P 500 (SPY) surpassed the 50-day EMA and closed above the 200-day EMA. Notably, the 50-day EMA has begun to flatten around the 10% drawdown level. This brings the SPY back in line with the July 2024 highs.

We observed the SPY's performance relative to the RSP (the equally weighted S&P 500) improve and cross its EMA this week on the weekly time frame.

Accompanying the strong price action this week was a breakout in the Advance Decline for the S&P 500.

Sector Overview

The breadth across sectors indicates strength in the short term, while longer time frames show weakness. The Utilities sector (XLU) continues to demonstrate strong breadth.

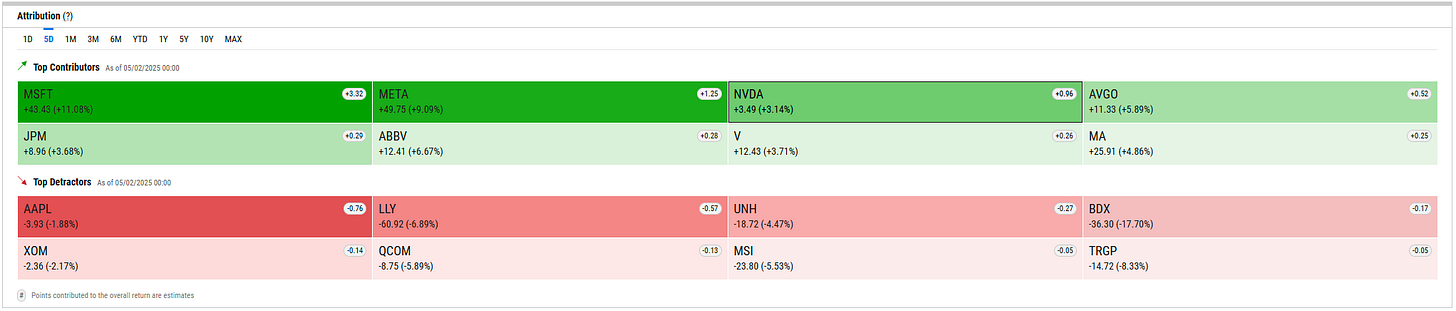

Industrials (XLI) led the way this week, followed by Technology (XLK). Only one sector experienced negative performance: Energy (XLE). Currently, only three sectors are in the negative for the year: XLK, XLE, and Consumer Discretionary (XLY).

Tech names were the top contributing stocks to SPY’s performance this week.

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.