S&P 500 Overview

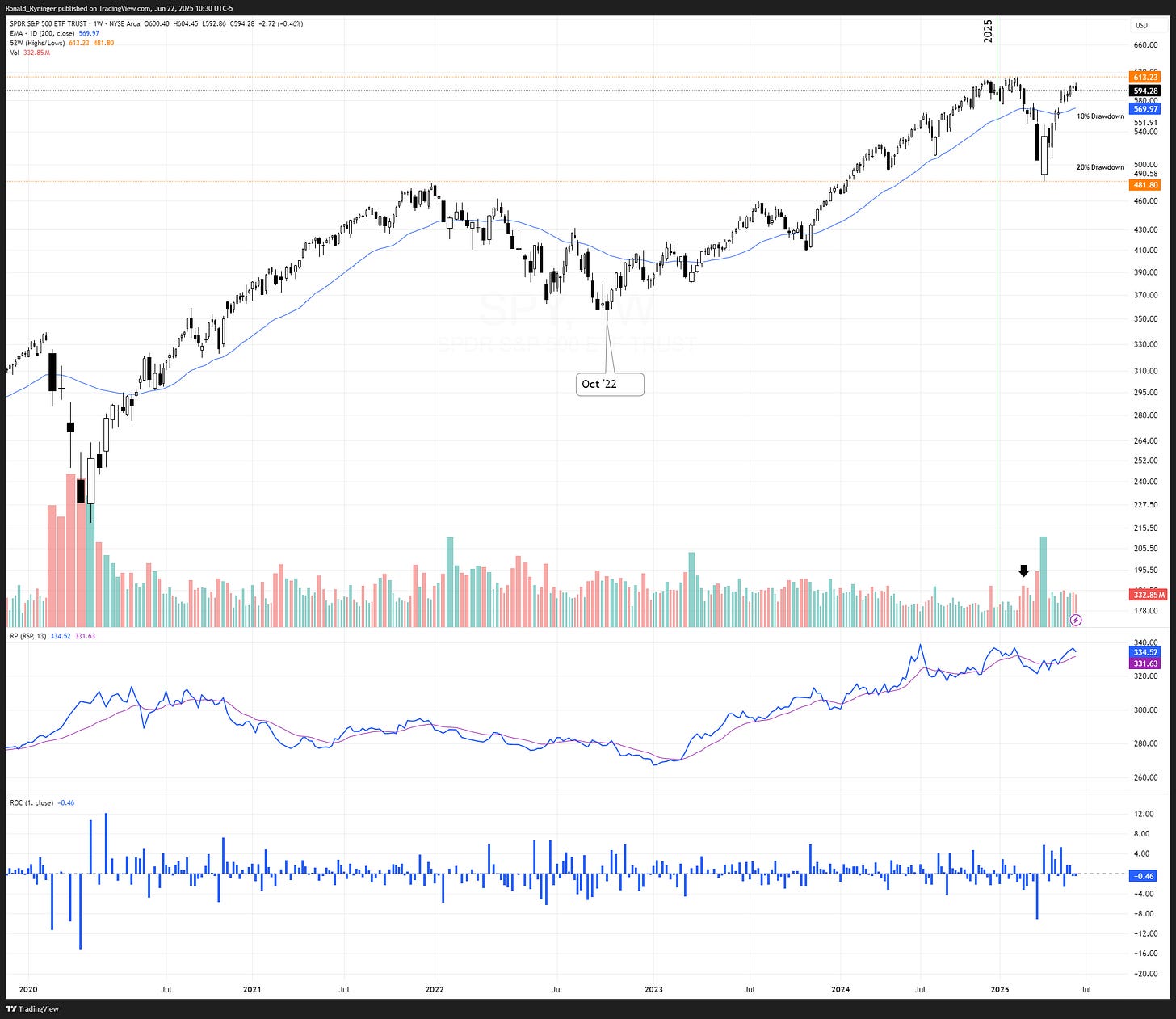

This week, the S&P 500 (SPY) closed 0.46% lower than last week, at 594.28 vs. 597. This keeps price action between the October 2024 high and the all-time highs set in February 2025.

The equal-weighted S&P 500 likewise had a quiet week.

Momentum’s lead is strengthening as other factors appear to be weakening.

Sector Overview

Energy (XLE) led performance this week, returning over 2%. Healthcare (XLV) was the laggard.

Sectors such as Finance (XLF), Energy (XLE), and Communication Services (XLC) are showing moderate to strong breadth.

Thoughts & Comments

The SPY feels undecided to me. It appears to have lost momentum and will not retest the February 2025 all-time high. I will be interested to see what effects, if any, this weekend's events have.

Disclaimer: Content is provided for informational purposes only and is not a recommendation to buy or sell any security. Please do your own research before making investment decisions. All information is from personal research unless otherwise noted. Best efforts are made to ensure that all information is accurate, but unintended errors and misprints may occur. I may own positions in the securities discussed.